I really enjoyed reading this marvelous book from Daniel Yergin. He actually wrote a Pulitzer Prize winning book called the The Prize: The Epic Quest for Oil, Money, and Power. I watched its documentary by the same name in which the author Daniel Yergin narrates it. Amazing watch. Below are my thoughts on the book

Oil has been the backbone of the world's industrialization and development. There have been quite a few panics around the supply of oil (peak oil/ Hubbert’s peak).

But every time there was a solution - new discovery of oil, or better efficiency during oil production and processing etc which saved the day. When an oil field is discovered estimates are often on the low side. With more research proven reserves increase.

Additionally, it is also true that the vehicles of today are much more fuel-efficient than before and since transportation is the biggest consumption of oil it has had an impact.

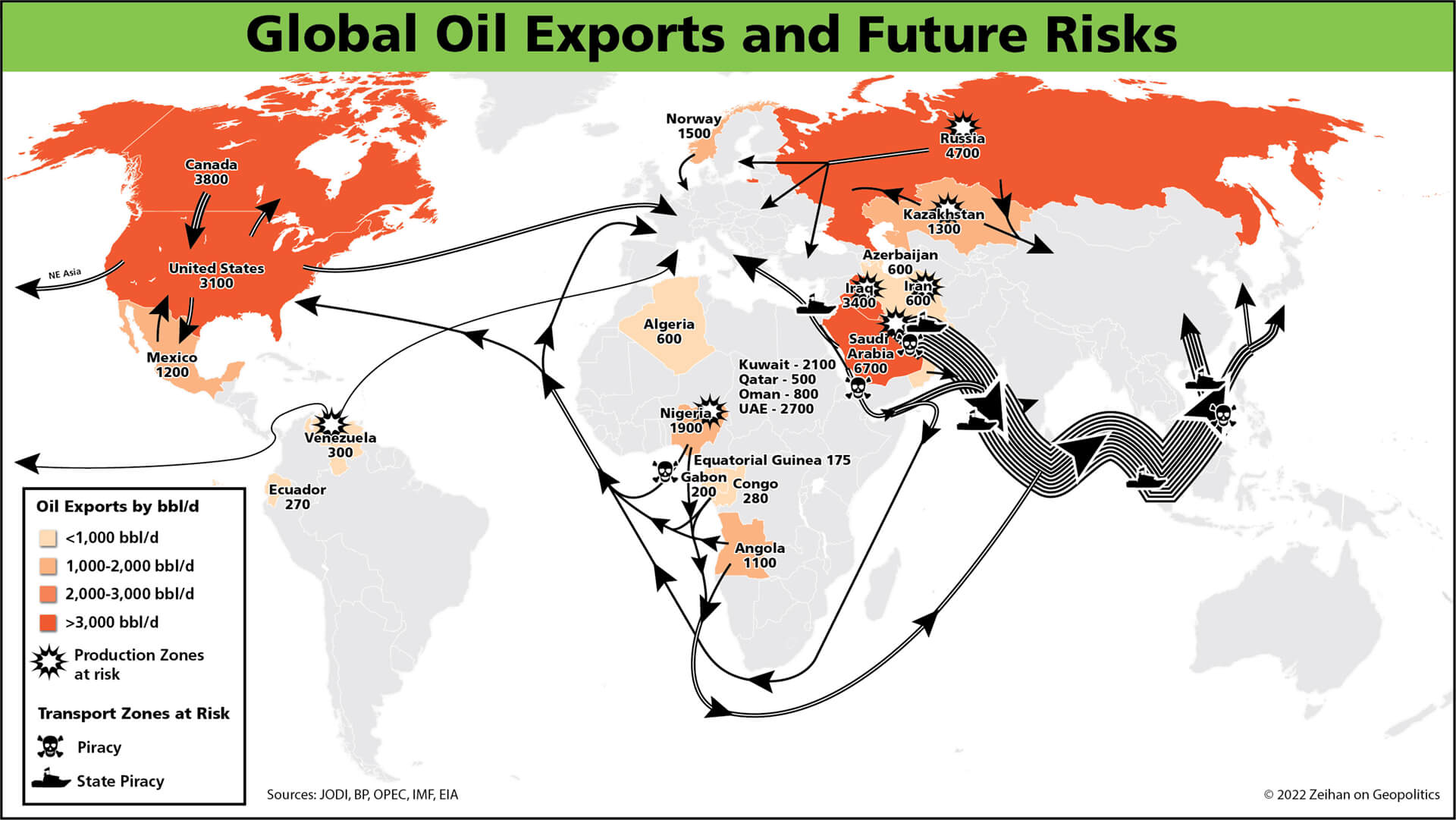

Due to discovery of oil elsewhere - North Sea, and new sources like tight oil, shale gas have helped to reduce OPEC’s dominance in the oil market. World daily oil production is 110 million barrels per day (mbd).

Oil’s biggest enemy

Oil’s biggest enemy is high oil prices. High oil prices result in lower demand, glut and also provides for more focus and funding on renewables. Eventually, an equilibrium is arrived at and oil prices fall. This cycle has repeated itself many times. Oil prices have risen to great heights and collapsed. And with its collapse the efforts on alternatives like renewables fizzle out.

Another factor that has reduced OPEC’s control over the prices is its financialization. Trading of oil futures and contracts, and hedging is done by anyone at the mercy of oil prices like airlines and even countries whose economies rely on oil prices. Heavy trading happens at NYMEX (New York Mercantile Exchange).

Almost every country is trying to diversify their energy sources away from oil - coal/natural gas/hydropower, solar. Also, in order to achieve that it is possible there are tensions and maybe clashes between nations.

Qatar is betting big on LNG. LNG is compressed into a liquid at very cold temperatures and then stored in special containers, shipped over sea and re-gasified and given to consumers.

NUCLEAR POWER

Oil’s Fault Lines

Oil’s importance has resulted in multiple conflicts in the past and still has the potential to ignite a conflagration. Circa 2004, China came out of nowhere to shock the oil industry with a huge spike in demand thanks to its rapid urbanization. Because it was late to the game, China was willing to pay a premium to get access and offer value add. It has been especially effective in African countries. Chinese oil companies have acquired abandoned oil fields in Africa and put in money to develop those oil fields.

Couple of Straits (Strait of Hormuz in the Persian Gulf and Malacca Strait in South China Sea) hold significant importance because of the immense volume of tankers that flow through them.

Electricity

Electricity is very different as it’s one second here and another second there. Oil can be stored in tanks, grain in silos, natural gas in underground caverns - but electricity can’t be stored. It is a business with virtually no inventory.

Power utility companies generate electricity using a fuel depending on the constraints of region and geography. It can be coal/oil/nuclear power/wind etc or a combination of them. It is too risky for an utility to overcommit to just one source/approach because of technological advancements/fuel costs/public opinion - thus they diversify.

Electric power is the most capital intensive major industry. No utility is going to sink money into a plant only for a decade. A power plant is supposed to operate for decades. However, there exists a wide gap between the needs and the expectations people have. In my research - I found multiple power utilities have accelerated the retirement of their coal powered plants in the last couple of years but still the public perception doesn’t acknowledge this progress.

It was eye-opening to read about the California power crisis in 2000-01. My impression was that it was solely due to the unscrupulous power company called Enron. But turns out there was more to it. Because of excessive regulation utilities weren’t allowed to pass on increased costs to users (residential/industries) as the government prohibited them. Thus, the demand-supply equation was totally off-balance.

Renewables

In the last 50 years, many times the pendulum swung in favor of renewables as oil prices shot through the roof and it swung back towards oil as prices collapsed and both funding and research in renewables dried out. Wind/Solar may be free and intermittent sources but there are costs associated to harness it in large volumes, put it through the grid and deliver to the customers. And still keep a backup around for any inadvertent circumstances.

Also, it may be easy to say switch to renewables but there has been stubborn opposition towards them. Opposition to nuclear power plants was predictable to me but I was surprised to read about opposition to even offshore wind. Cape Wind project was supposed to setup offshore wind farm in the ocean but some residents claimed that the project would ruin scenic views from private properties as well as views from public properties like beaches, as the turbines would be only 4.8 miles from shore and therefore would decrease property values, ruin popular areas for yachting, and cause other environmental problems! Anyways, finally in 2021 a different offshore project got green light (Vineyard Wind)

My Takeaway

Like it or not, oil would be around for at least a couple of decades as a sudden transition as some activists are demanding is going to give a serious jolt to the world economy and people’s lives. And the world is just not ready to switch to renewables yet because renewables unit economics’ is not at par with oil & gas. Infact, the United States electric regulator (FERC) said in 2022 in a report that the electric grid cannot handle every household plugging in two electric cars at night. Then there’s the separate topic around rare earth metals and their extraction process.

The best way forward in my view is to encourage utilities to move to renewables where possible and move towards fuel efficient vehicles and public transport. And hope technological advancements and market forces make renewables an attractive option than traditional fuel sources.

1 comment:

Very good

Post a Comment