I think this book is a very honest attempt to explain why guaranteed income is

needed specially now.

Some of the reasons why it

is in the news is because of the looming threat of Artificial Intelligence

which

is going to change the

nature of economy but keeping that aside there are strong enough reasons to

consider it. Even though employment numbers tell a different story (less

unemployment) - the number of people living

paycheck to paycheck, doing more than one job with no benefits - has increased.

The benchmark of “employment numbers” no longer fully reflects the reality.

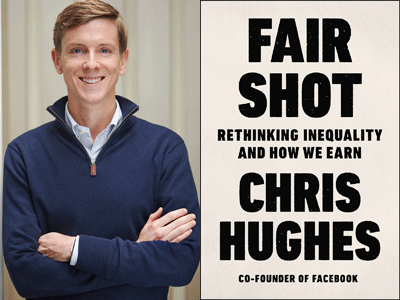

The author Chris Hughes’

Facebook co-founder has been humble enough to admit that “he got lucky”. His

working class parents did just enough to provide him with opportunities

(education) and he ended up at Harvard where he happened to choose Mark

Zuckerberg as his roommate - what if he hadn’t?. It then turned out that they

created Facebook and he ended up with half-a-billion dollars even before he had

turned 30.

From his life story you get

that working class vibe which is totally true.

He seems to have done a lot

of introspection how he ended up in the 1% of the population and so young and

it seems to have had a profound effect on him.

He makes a very passionate

case for Guaranteed Income.

Everyone seems to have

their own definition/interpretation of Guaranteed Income. It is sometimes

called as Universal Basic Income i.e for all the people. I was a little

surprised by his manifest for Guaranteed Income (note - he doesn’t call it UBI)

but he does make a strong case for it with solid numbers and study as evidence.

He calls for every working age adult making less than $50,000 a year to be

given a $500 month which would be paid for by the top 1% - total budget

for it would be $290 billion i.e less than half of the US defense budget or the

Social Security system. In Chapter-9 he also points out that there are some

ridiculous tax loopholes which if plugged can provide funding for such a system.

Like, Warren Buffett pays less tax than his assistant cause if you earn more

than $250,000 a year - your capital gains tax rate is less and if you inherit

some property or a mansion - you do not pay tax on it. Popular loophole for the

ultra-rich.

This gives a very

reasonable estimate for the programme and also answers a popular criticism of

who’s going to fund it.

Also, there’s a common

tendency to label the recipients of such a benefit as lazy or few other

derogatory terms - but I find it appalling and the author also points out that

such efforts in the past have been invasive - asking extremely personal and

uncomfortable questions to females.

A relevant reading would be

“Regulating the poor”.

I also got the sense in

Chapter-8 about how extremely difficult it is to get such a bill (or as a

matter of fact any bill) passed in both the Houses. Everyone has their own

views, understanding of the subject and are eager to leave their own stamp on

the bill - which leads to concessions, negotiations, stalemates and a few times

it all works out.

I was a bit confused about

why guaranteed income implementation is needed when there’s an Income Tax

credit (EITC). There’s a chapter about it but I’m not fully clear yet.

I don’t say it often but

this book has a very sincere moving “Afterword”!

To summarize I agree that The

natural drift of capitalism toward inequality requires a constant vigilance to

make the market for everyone, not just for the rich. And such a system is

needed.

P.S -

It was remarkable to note

that MLK was in favor of such an idea but was assassinated before he could

start a movement for it. Alaska already has a similar prototype, Permanent Fund

out of which all Alaskans are on an average paid $1400 a year and it has

relatively less inequality.

Links - Stockton

California,