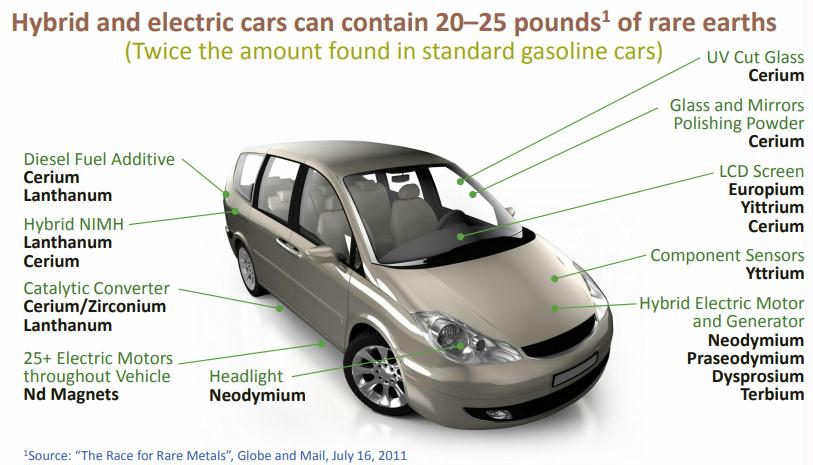

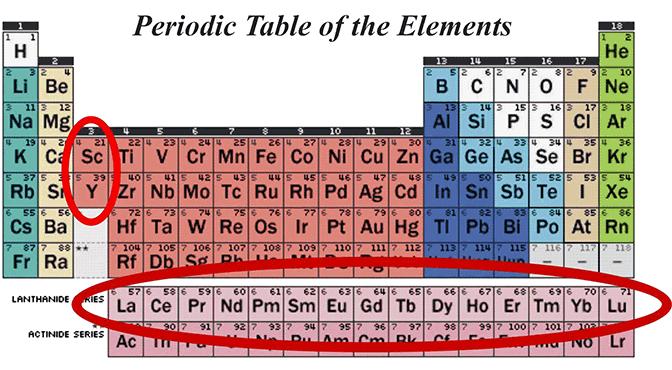

There is an ongoing movement to phase out the fossil fuel industry and replace it with everything electric. This book talks about some of the key things needed to make that happen but are overlooked - and that is the rare earth metals. These metals go in the power-train of an electric car, or to manufacture power magnets which go in electric vehicles.

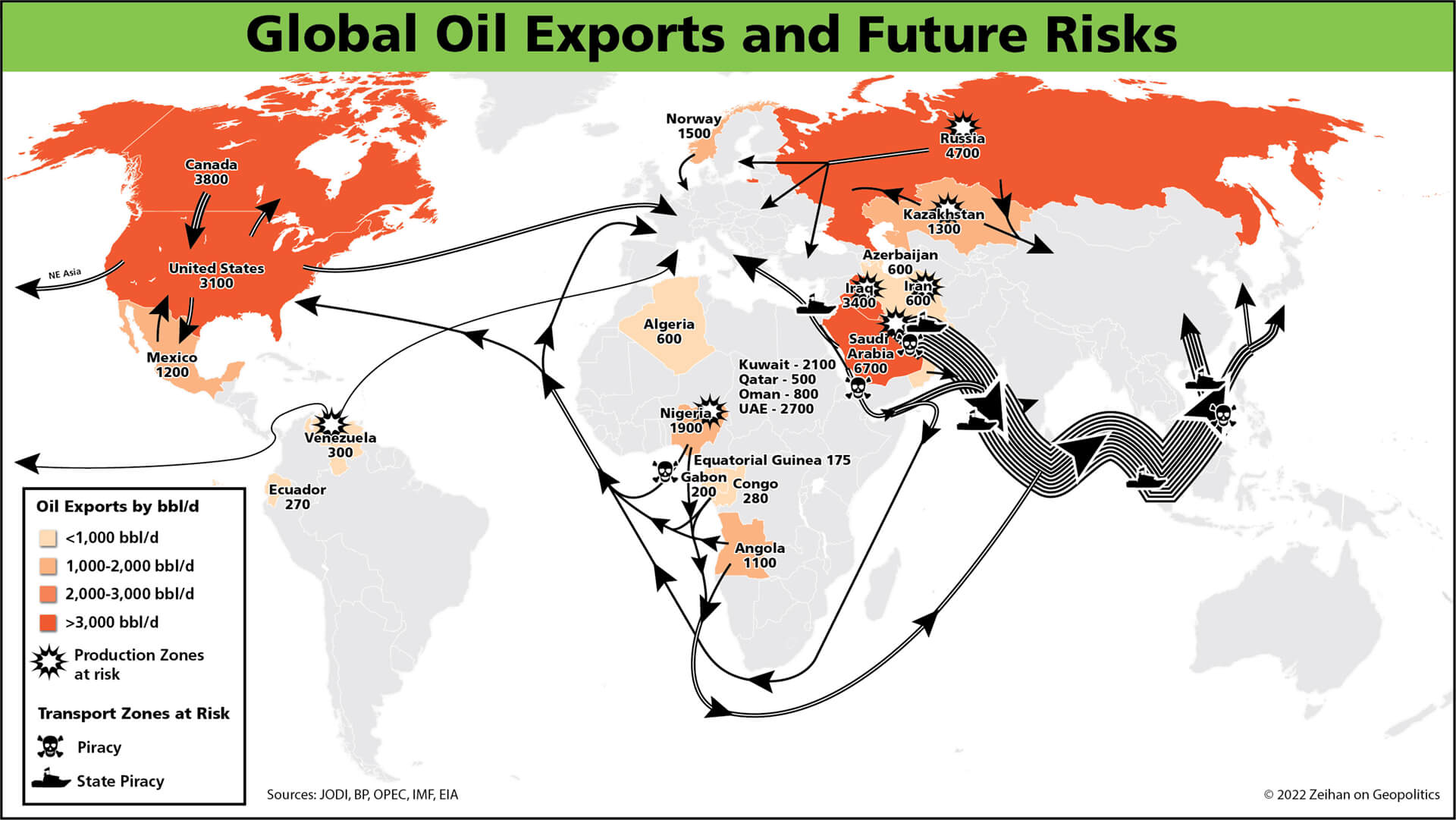

As one can imagine - these materials will need to be mined from the Earth. They are spread across the globe across different countries from Angola, DRC in Africa to Kazakhstan in Central Asia to the biggest producer of them all - China. Access to these materials is a must to have the electric movement succeed. And there are many different caveats around this! The author does a decent job of explaining them.

Is Mining Rare Metals Environment Friendly?

Currently, cities in East China/Mongolia (Bataou, Dahlia) are the poster-childs of how “clean energy” is not clean. These cities sit on top of reserves of rare metals but the cities are full of the toxic sludge containing Hydro-sulfuric acid used to wash and clean the deposits to extract the minerals via the process. BBC even did a report on this in 2005.

Worth remembering - after extraction there is an elaborate process to extract the metal which consumes thousands of gallons of water. This is where the concept of EROI (Energy Return on Investment) comes in. EROI is the ratio that measures the amount of usable energy delivered from an energy source versus the amount of energy used to get that energy resource.

Can recycling of Rare Metals compensate for mining?

The answer is NO as of today based on the technology available. Even Apple - the company with abundant capital and resources is only able to manufacture products only with 20% of recycled materials. Rest of the materials like Tungsten etc - it sources from suppliers around the world. Apple's Environmental Progress Report 2021

Role of China

If for Oil - OPEC produces 41% of it, then for rare metals China today produces 95% of them - such is its vast influence on it.

The Western Hemisphere has only two mines left- one in Australia (Lynas) and another one in California (Mountain Pass). Rest of the mines in Europe had to shut down as China dumped the market with so much supply that mining became a highly unprofitable endeavor.

Also, China has instituted export controls (export duty) on rare metals to thwart foreign companies relative to its domestic companies. Due to these export duties, input costs of foreign companies increase as China is the only major supplier today. Other countries in the Southern hemisphere like Indonesia have also followed suit by limiting exports of raw materials as they too try to climb up the value chain.

Another factor has been the vociferous movement against mining in the Western world which has resulted in a sharp drop in public approval for the mining industry resulting in shut-down of mines all across Europe and the U.S.

Criticism

- doesn't make sense as explained further above.

Final thoughts -

At this moment in time I agree with the author’s assessment that the public doesn’t realize that trading oil fields for rare metals deposits means more mining of rare metals deposits and mining isn’t an environmentally friendly process either. And we haven’t discussed at all about how the vast demands of electricity would be met when every vehicle would be electric. Western development model seems to be mired in some contradictions. Dreams of a green and more technologically advanced world doesn’t seem to be that clean.