The book's central theme is perfectly captured in the subtitle - Mapping the Collapse of Globalization. The author lays out in great detail how Jan 2020 was the peak of globalization, and the onset of the Covid pandemic marked the start of the demise of this global order. Post World-War II the world was together in a way in which security was no longer a concern but keeping costs low was. This was solely possible due to the U.S guaranteeing security under its alliance in exchange for opening its market to other countries who joined. Trade was the norm of the day with capital flowing freely to investment opportunities aided at times by the credit cycle.

But with the U.S retreating from the current position - global trade will have a serious dip, globalization will collapse and the era of abundance will be over. Trade will not be as seamless and smooth as before due to a bunch of security concerns and inward looking perspectives.

Various other factors will also hasten the demise of globalization -

Demographics

The author places a lot of importance on Demography which I felt odd at first but as I read along I understood better its significance. The key thing with demographics is that you cannot change it/reverse it/innovate around it even with infinite amounts of money. If there are less children today it guarantees that there will be a small labor force 25 years from now. Also, keep in mind that the most of the spending a person does occurs between the age of 15-45. Thus a lopsided demographic may not help.

The replacement rate is 2.1 and a lot of countries in Europe are past the point of no return. Some Asian countries like Japan (oldest society in the world) and China (fastest aging society) are also on that path.

Demographics are visibly shifting as baby boomers (born in 1940-60s) retire rapidly in 2020 and 2030s. And they will no longer have any new income to invest in fact they will also change the profile of their investments - from risk taking to risk averse. Combined with rising interest rates this change in investing choices of the richest generation will dry up capital for many industries.

Another impact would be on tax revenues. Gone are the days of 2000-10s of a tax-heavy, mature worker heavy demographic and with the days of 2020-30s of tax poor and retiree heavy demographics.

Thus, if the consumption economy starts to sputter thus will the related export/manufacturing led economies like China which thrive on supplying and meeting the endless demand for products.

Region | TFR (2015-2020) |

|---|

Africa | 4.4 |

|---|

Oceania | 2.4 |

|---|

Asia | 2.2 |

|---|

Latin America and Caribbean | 2.0 |

North America | 1.8 |

Europe | 1.6 |

Capital

The era of easy free money is over. Poor capital allocation decisions and an easy money credit cycle has propped up a lot of industries (and has led to many innovations) - in place of profitability. Conditions of the last 13-14 years aren’t coming back. Fiscally prudent economies will survive and there are not many in that category.

- Countries have grown credit at a rapid pace and Monetary expansion is Inflationary.

- Coupled with falling consumption habits of an aging population is Deflationary by nature.

- Building a new supply chain, a new plant not dependent on globalization is Inflationary.

Thus, a dizzying number of factors will pull the economic stability in all different directions.

Renewables

I liked the nuanced take of the author on renewables. He says that he’s a believer in green tech when it's matched to correct geography.

The example given is of Austin v/s Denver. Even though TX is hot, sunny - Denver which is the sunniest metro area and at a high altitude there is no humidity and no air to block sunlight is more effective for solar. Also, most parts of the world are neither very windy nor very sunny.

On-demand electricity is a very important concept that currently can’t be fulfilled by renewables as of today.

Also, the hastened rush to phase out oil & gas can cause a lot of problems. Worth remembering, oil is also the base material for the building world's petrochemical needs. Modern petrochemicals are like food packaging, medical equipment, footwear, tires, diapers.

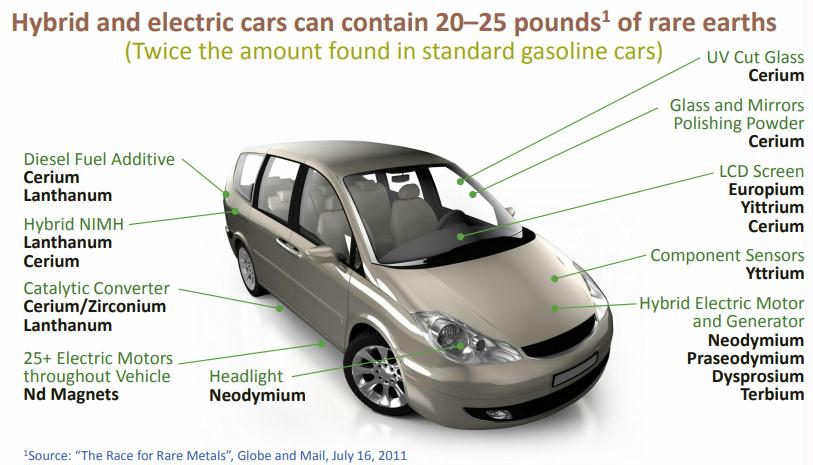

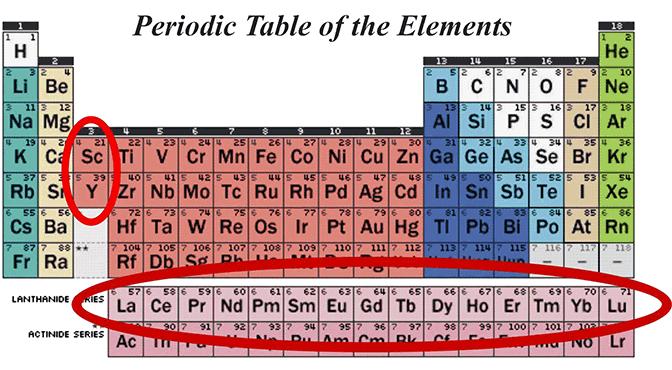

Greentech requires much more Copper, Chromium and Lithium. And the supply chain of these rare metals are much more complex than oil & gas (OPEC). Also, worth mentioning that mining these rare metals is not an environmentally friendly process.

However, amidst all this per the author the US will continue to have enough supply of these materials as it will retain access to the Western Hemisphere and Australia and also a powerful military to go out there and get what it needs.

Agriculture

This was very interesting as it's not exactly obvious at first how globalization and agriculture are linked. But it made sense. Fertilizers - nitrogen, phosphate and potassium are chemicals but none as important as potassium fertilizers. It comes from a mineral potash which is found mainly only in 6 countries. With the collapse of globalization, the supply chain for global fertilizers will also collapse, forcing some to substitute it with organic foods or manure.

Here the author provided an interesting outline of organic - they aren't environmentally friendly as they consume a lot of water, require chemical free fertilizers & herbicides which are expensive and have a low yield/acre requiring more acreage.

Also meat supply chains will suffer too. Due to globalization caloric intakes have increased and there are a bunch of sources now. But that may be going away.

My take

The author is unbelievably bearish on China - he thinks not only that country will implode due to severe disruption in supply chains, but also be affected by slowing consumption rates in the West due to an aging population and finally its own demographics will vanish it's labor force and eat it's cheap manufacturing advantage.

At the same time the author is very bullish on the United States. Even though a retreat from the world stage wouldn't hamper it's prospects as per him. He gives three reasons - strategic geographical advantage, very strong military and a global reserve currency (dollar). Now I'll take it with a grain of salt considering many financial institutions and even the U.S military are clients of the author's geopolitical strategist firm.

Good book overall. Got to learn about quite a few trends and some not-so-obvious changes which are lurking around the corner.

P.S -

Although at few places it feels like the author is B.S. He says "... for manufacturing machinery Germans are so good at it due to their penchant of being so precise. Americans are not at the same level but not too far behind as 2nd." Really? No other country can manufacture machinery?