For some strange reason I was drawn towards finance

and market. I took up Economics 101 and Finance 101 as optionals in my

undergrad. Thanks to it I could at least attempt to read the Business page of

the newspaper instead of directly flipping over as 95% people do.

Twice I attempted to read “Fault Lines” by RBI governor Raghuram Rajan and had to put it down

in between. It has to be the toughest book (non-curriculum)

I have read (unsuccessfully) till

date. The book talks about how Rajan could foresee the 2008 economic crisis

before many of his peers and even had the guts to call spade a spade. He was one

of the few people to have correctly called the crisis as coming.

Anyways the botched reading attempts didn’t dissuade

me. I had already gathered a fair idea about the economic crisis 2008 and its

causes from the internet and my 101 classes. Impropriety, no moral compass,

government hand-in-glove with the executives in lieu of their funding, no

accountability and astronomically high bonuses for the CEOs irrespective of the

company’s performance are some of the key reasons that came up on trying to

figure the problem. Surprisingly the same reasons came to the fore when I read Liar’s Poker – giving an account of late

1980s i.e. roughly 20 years before 2008. Nothing had changed in those 20 years!

While Wall Street did very well to come up with innovative new financial

derivatives (CDOs) but everyone turned a blind eye to the unethical, unfair

prevalent practices.

I accidentally happened to come across a list of “Movies

to Watch” which centered on finance and markets. Quickly I saved it and

gradually started ticking off them one by one.

If you watch “Too

Big To Fail” - you will realize how blatantly the financial institutions

kept aside all caution and rules in the mad race to make more money. It pushed

the world on the precipice of a financial collapse and it did. Sadly no one was

held accountable for why proper due diligence was skipped. The financial system

already had enough checks & balances – but they were rendered useless

because those who were supposed to ‘Say No’ didn’t say NO! And one major reason

for it is that those in the higher echelons in the finance world (investment

banks etc.) were in cahoots with those running the Office or planning to run

for the office. On watching the Academy Award winning documentary “The Inside Job”

– you will end up shaking your head in disbelief to see as to how come the head

of investment bank (to know the name

watch the documentary J) who threw all caution to the wind was appointed as

an advisor to the US President. And this is after he took home a million dollar

cheque even though most of the people around him lost most of their

life-savings primarily due to his company’s reckless behavior. No

accountability!

However, a non-descript country like Iceland showed

the way when it punished the bankers responsible for the financial crisis. It’s

a long shot but let’s hope that others follow suit too.

If you think that what happened in 2008 was only the

one time all these reasons combined together to create havoc at such a large

scale – then you’re wrong. The most

spectacular collapse in the history of Wall Street has to be Enron. All the

reasons which precipitated its collapse are exactly the same as 2008. In fact,

I should say the other way round – the reasons why 2008 financial crisis

occurred were the same as late 1980s and 2001-02. Absolutely no heed was paid

to the lessons learnt and we have no reason to believe that this won’t happen

again.

|

| Fortune Magazine [2000] - Enron was the most admired then |

However, Enron scandal has to be the mother of all

accounting and financial scandals – the company fooled the Wall Street

analysts, the regulators for 8-10 years – cooked up the numbers, showed profits

which were non-existent, hid its debts thanks to Mark-to-Market accounting principle.

Its executives took home multi-million dollar salaries and encouraged its 20000

employees to put their savings and retirement funds in Enron stock. They did

all this while completely knowing that the Enron stock which was shooting up

year after year was standing on thin ice. They even opened up a billion dollar

energy plant in Dabhol, India – and there were no cash inflows from it still

they propped up the investment as successful to investors.

It is a matter of little satisfaction that the

executives were punished but the amount of money people lost, the mental

anguish can never be compensated.

I got to know most of this when I watched “Enron: The Smartest Guys in the Room” –

again an Academy Award winner and also mentioned on the Movies to Watch list.

Another key standout from it was the California Energy Crisis (2000-01). In the state of California, electricity was deregulated thus

it had many players who could price it based on the demand. A few blackouts occurred in the state of

California while it was struggling to supply power and Enron made use of it and

used to shut down its power plant which abnormally increased the demand

resulting in the increase of electricity prices to 800%. Naturally, the

incumbent governor (Gray Davis) was blamed. However, Enron president (Ken Lay)

was a close friend of George W. Bush who as the President refused to put a

federal cap on the electricity prices. Ken Lay invited Arnold Schwarzenegger for

a lunch in May 2001– and by some strange co-incidence Arnold defeated Gray

Davis in the polls for the next governor in 2003. Anyways, Enron pocketed billions

exploiting Californians misery in 2000-01 while they didn’t earn a penny from

most of their other ventures.

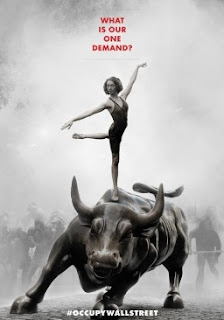

This is one of the most glaring examples of how

dangerous Capitalism and free markets can be. No wonder we have movement like Occupy Wall Street going on where people

are demanding a reduction in the influence of

corporations on politics, more

balanced distribution of income, more

and better jobs, bank

reform (especially to curtail speculative trading by banks), forgiveness

of student loan debt, and alleviation of the foreclosure situation.

Although it is unlikely that their demands will be

met anytime soon until matters come to a head, but with economic crisis spreading

its fangs in Greece, Portugal, Spain and now in Puerto Rico (defaulted on Jan 1,

2016) more and more people will see the crystal clear disparity. Only the top

1% hold most of the wealth (90% and above) in almost all countries – a perfect

recipe for unrest, disharmony and all that is anti-social.

No comments:

Post a Comment