This was yet another book picked up on a whim. And by the time I finished reading it turned out to be classic investment advice book. Needs to be added alongside The Intelligent Investor and Margin of Safety.

The author David Dreman seems to be in the value investor camp and champions contrarian investment strategies. There were some important investment lessons in the book!

He started from basics reminding how it is very difficult to spot a bubble until after the fact when its bursting confirms its existence. And there’s a reason for that. To a crowd few images are more alluring than the promise of instant wealth and everyone FOMO’ing into those asset classes. This is where the human psychology comes into play. Because if the potential outcome of the gamble is emotionally powerful, its attractiveness is insensitive to changes in probability. No wonder psychology becomes an integral part of investment. The book does a good job on reminding the humans cannot process large amounts of info. Investors mistakenly believe that with more data points they can predict/forecast accurately but that's not the case!

The book then delves into the Efficient Market Hypothesis (EMH) and a lot of pages are devoted to why it’s inaccurate backed by many surveys, studies, and contradictions. Although at some point, it started to feel like a rant to me.

David Dreman does share his secret sauce later – describing how low P/E, low P/B, low P/CF and low industry average stocks tend to do well over a long period of time and also remain relatively unscathed during periods of high volatility. I get that this book is a reprint edition of 2012 thus data of most of the surveys referenced is dated up to 2010 alone. I was interested to look for data within the last few years where growth stocks and mega caps like FAANG have been the hot picks. It’s relevant cause they have traded at expensive multiples thus my guess is that Dreman’s strategy would have always excluded them and robbed the investor of crème de la crème.

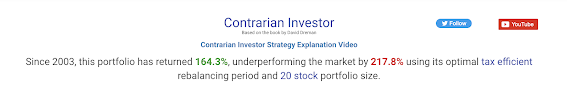

I found a fund which runs a portfolio based on David Dreman’s contrarian principles and it seems to have under-performed the market by ~53% since 2003.

https://www.validea.com/contrarian-investor-portfolio/david-dreman

Nonetheless, the book served as a good refresher of certain key fundamentals-

- Never FOMO

- Position Sizing matters a lot

- Never place too much trust in analysts

- There is a chapter where Dreman goes into lot of detail about how analysts have huge conflicts. The brokerage firm where they work, also has an investment firm which wants underwriting opportunities in offerings. And a lot goes on behind the scenes to curry Buy side recommendations and invites blowback too on Sell side recommendations.

- Valuation matters aka multiples matters.

- Liquidity and leverage together can be huge risks as proven time and time again. Stay away from leverage!